User blogs

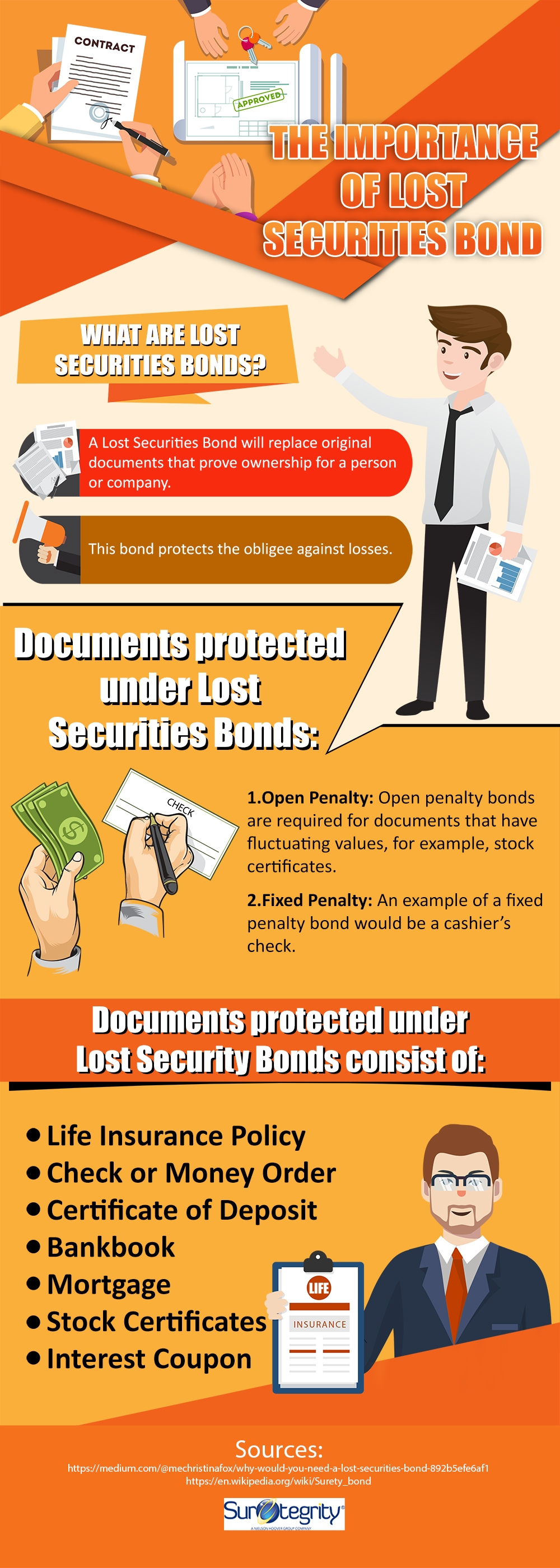

This info-graphic titled ‘Get to Know the Importance ofLost Securities Bond’ provides us overview of bonds issued for lost securities. Lost instrument bonds have been around for many years and have chiefly arisen due to the loss of either paper share certification, bank drafts of cheque. Lost instrument bonds are a type of surety bond that defend the issuer of the securities in the case that duplicate instruments are issued. For example, let us say you owned 3,000 shares of Bell Canada and possess them in your home office among other paperwork. By mishap, those papers including the original share credentials are thrown into the scraps and cannot be found.

If Bell is going to issue replacement share certificates, they want to be secured in the case the originals are found and paid. A lost instrument bond supplies this protection. The same principle applies to lost certified cheque and lost bank drafts.

A strong surety broker can secure a lost instrument for you from a reputable and licensed surety company and depending on the size would necessitate disclosures around the following:

1) Circumstances of Loss or an Affidavit of Loss.

2) The Financial Strength of the Individual issuing the Bond

3) Stop Transfer Letter from the Transfer Broker

For more information, please refer to the info-graphic below.